*Certificate of Deposit (CD)

How Strategic Thinking Transformed the CD Journey

Grew

Grew

Grew

$2B+

132%

86%

Deposit

Engagement

Conversion

GOAL

Grow deposit balance

ROLE

UX Designer

CORE TEAM

UX Designer (Hugo)

Product Owner

Front-end Engineer

Back-end Engineer

Mobile Engineer

SCOPE - Full CD Journey

3 Projects

9 Months

FRAMING

The Spark Behind the CD Redesign.

In June 2023, the Deposit Business Owner proposed letting members open multiple CDs at once.

I asked, “Why would that drive more openings?” The room went silent.

That silence led me to uncover the real issue: the CD opening flow was broken.

That single question sparked everything that followed.

SOLUTION

New CD Opening

Grew

86%

Conversion

Grew

$1.5 Billion

Deposit (Yearly)

Avg.

1m 21s

to open a CD

Old design

Key strategies

TRUST

Ensure accessibility of explanations

Avoid jargon language

Maximize members’ benefits

SUBTRACTION

Remove unnecessary steps

Reduce redundancy

Cut visual noise

After delivering the new CD opening, I convinced the Product Owner to invest in other key opportunities:

CD Renewal and Explore Products.

.

.

.

SCALE UP

New CD Renewal

Retained

$140M

Monthly

Grew

35 → 61%

Auto renewal flag

Old design

Introducing Explore Products

Raised engagement by 66%

Old products access

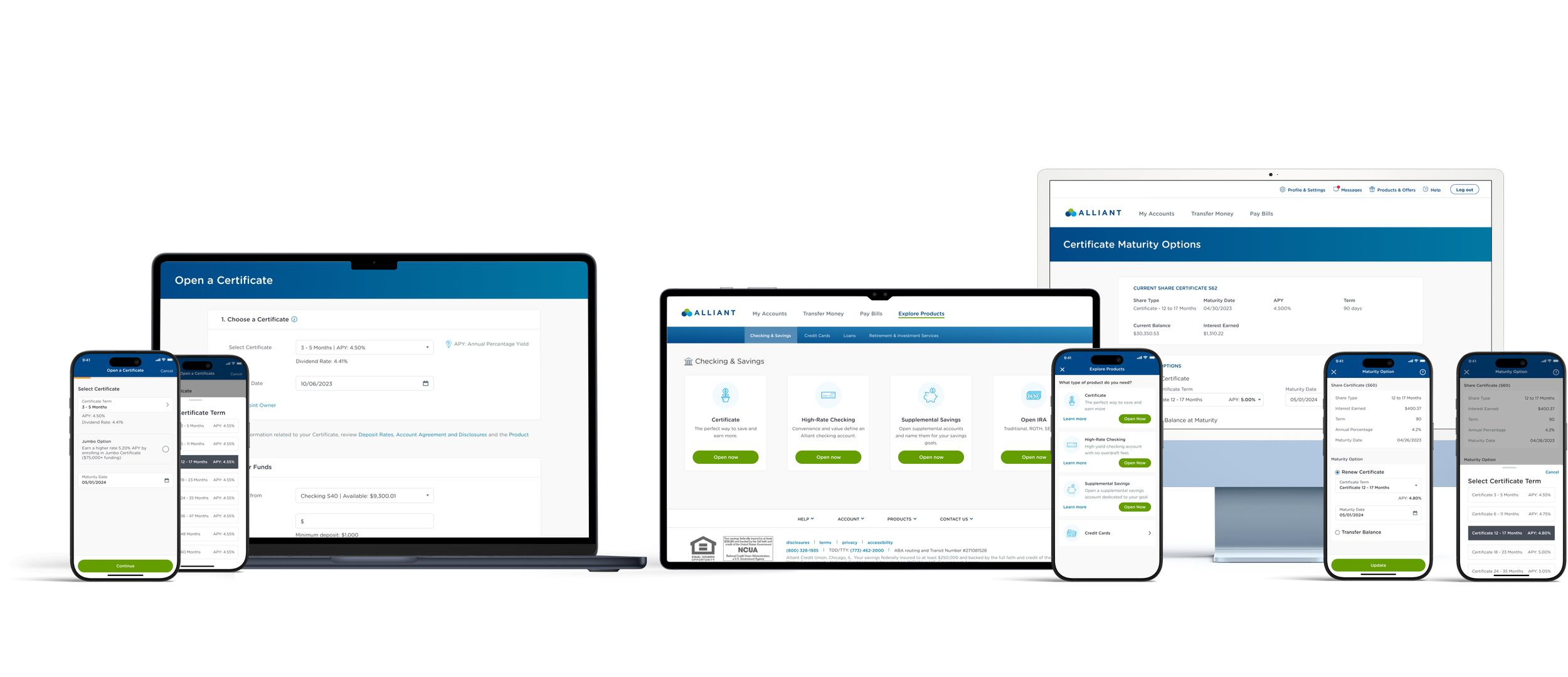

MOBILE

CD Opening

Mobile

CD Renewal

MOBILE

Explore

Products

SYSTEMIZE

One design,

many solutions.

UI components from this project now support multiple product flows, enabling rapid redesigns for credit card, checking, and savings applications..etc.

Please reach out for the detail process.